It has been a difficult couple of years for first-time homebuyers. November data from the National Association of REALTORS® (NAR) reveals that first-time homebuyers reached an all-time low in 2024: they accounted for 24% of total home sales

in 2024, down from 32% in the previous year, and the average of 37% for the years 2003 to 2023. Additionally, the median first-time homebuyer age in 2024 was 38 years old, up from the range of 29 to 33 years old for 1981 to 2021.

The historically weak number of first-time homebuyer data comes at a time when the millennial cohort is peaking. So, let’s take a look at the headwinds that first-time homebuyers are facing and whether those headwinds will persist in 2025 and beyond.

Headwind 1: Mortgage interest rates

At 6.60% as this magazine went to press, current mortgage interest rates are on par with the 6.75% average mortgage interest rate over the past two years, and not far off from the 6.48% average rate for the years between 2000 and 2007. From the second

quarter of 2009 until the first quarter of 2022, mortgage interest rates were artificially low, averaging 3.98%, due to the Federal Reserve’s quantitative easing after the Great Recession and the COVID Recession.

These formerly low mortgage interest rates have the unintended consequence of limiting the number of existing homes entering the market today. Estimates by Zelman and Associates for September 2024 revealed that 58% of outstanding mortgages had interest

rates of 4% or lower. Why sell your home with a low mortgage interest rate and move into another home with a higher rate?

Additionally, during the Fed’s quantitative easing and COVID easing, the central bank purchased $2.7 trillion of mortgage-backed bonds. In contrast, prior to 2009, the Federal Reserve had no mortgage-backed bonds on its balance sheet. From the second

quarter of 2009 to the beginning of 2022, the Fed purchased over 30% of outstanding agency mortgage debt, and in that process, the Fed brought down long-term mortgage interest rates.

However, the opposite is also the case. Fed tightening, which started in March 2022, pushed spreads on mortgage-backed securities over 10-year U.S. Treasury rates from a 35-year average of 1.74% to 3.13% in June 2023. The spread currently is an elevated

2.20%: 6.60% 30-year mortgage rate less 4.40% 10-year U.S. Treasury rate, as seen in Exhibit 1. In short, not only have interest rates increased, but the spreads needed to sell mortgage-backed securities in the bond markets increased too.

Headwind #1: Mortgage interest rates increased from unsustainably low levels to more sustainable rates, making housing less affordable and existing homeowners loathe to sell.

Headwind 2: Inventory of homes available for sale

According to October 2024 data from Harvard’s Joint Center for Housing Studies, the number of homes for sale in the U.S. is alarmingly low at 1.37 million units, down 18% from the same month in 2019 and down from 2.5 million units in 2004. The months’

supply of for-sale housing fell to 2.8 months in February 2024; and since that time, the months’ supply of for-sale housing increased to 4.2 months as of October 2024.

Similarly, in October 2024 for Wisconsin, the number of active listings

was 12,293, up from 7,242 in February 2024, and a 2021-2024 average active listing count of 9,391 homes. More broadly, active listings are down 67% between July 2017 and October 2024. See Exhibit 2.

Headwind #2: Limited supply of existing homes for sale is pushing up house prices.

Headwind 3: Home price increases

The limited supply of for-sale homes nationally and in Wisconsin increased single-family home prices, even as mortgage interest rates doubled. According to Fannie Mae, national house prices grew 5.9% for the year ending October 2024, with the greatest

price appreciation coming from the Midwest. See Exhibit 3. While high price appreciation for existing homeowners is wonderful, higher home prices limit the ability for first-time homebuyers to enter the market. Home price appreciation for the year

ending October 2024 reveals an 11% appreciation rate, according to WRA housing statistics. The historically low-cost housing areas of the upper Midwest have captured the interest of potential homeowners, pushing up prices across the Midwest’s manufacturing

belt faster than other parts of the U.S.

Highlighting the home price appreciation concern, over the past decade through October 2024, the annual compound house price growth rate in Wisconsin was 7.6%, outpacing the 3.7% hourly wage rate growth and the 2.9% inflation rate.

Headwind #3: House price appreciation is outpacing overall inflation and wage growth.

Headwind 4: All-cash buyers and household wealth

Data collected by NAR reveals that the median age of homebuyers in the U.S. year to date is 56 years old, up from 36 years old in 1981. The cause of this age increase is both financial and demographic. Through August 2024, 33% of homes were purchased

all-cash. All-cash buyers have greater flexibility and certainty of closing, relative to 25-to-33 year-olds, where 96% use financing to purchase a home with a median loan-to-value ratio of 90% and a 10% down payment. Compounding this concern, NAR

reports that 38% of 25-to-33 year-old homebuyers find saving for a down payment one of the most difficult things about buying a home.

Fueling the all-cash purchase of homes are gains in household wealth, which expanded by $50 trillion since the start of the COVID Recession four years ago, growing to $154 trillion. See Exhibit 4. For context, the top 50% of household wealth increased

on average $760,000, while the bottom 50% of household wealth increased to $28,500. Highlighting the wealth inequity in the U.S., the top 1% of households hold 30% of the wealth, the next 9% hold 36% of the wealth, and the next 50% to 90% of households

have 31% of the wealth. The bottom 50% of households hold less than 3% of the wealth in the U.S., making it difficult — if not impossible — to achieve the American Dream.

Headwind #4: First-time homebuyers are competing with older, all-cash purchasers.

Headwind 5: Homeownership affordability

Homeownership affordability is measured in a variety of ways, the most frequent being the ability of the median household income to afford the median homeownership cost. Atlanta Fed data reveals that housing affordability in the U.S. from 2009 through

2022 averaged 102, suggesting that the median household could afford 102% of the median house price. Since 2022, that number has fallen to an average of 74, suggesting that the median household income could only afford 74% of the median house price.

NAR uses slightly different income and price measures but has very similar results.

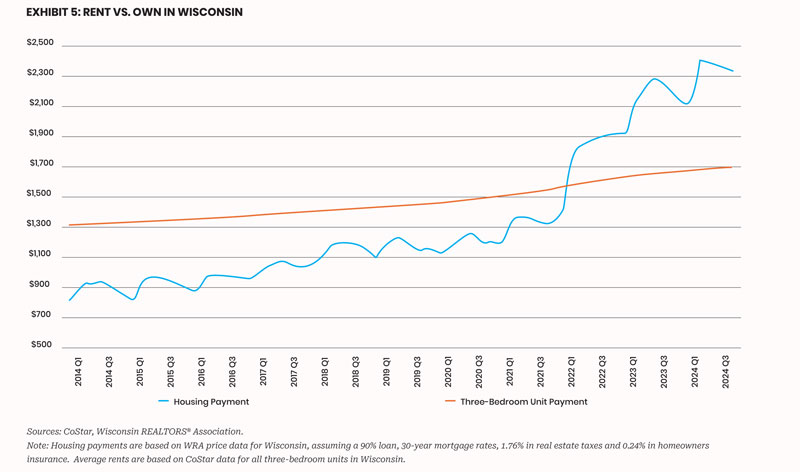

A second measure of homeownership affordability is the relative cost of renting vs. owning a home. Average rent for a three-bedroom unit in Wisconsin grew steadily across the past 11 years, from $1,301 in the first quarter of 2014 to $1,693 in the fourth

quarter of 2024, which accounts for 2.4% per annum growth. Different from rental rates, Wisconsin homeownership costs remained persistently low until the fourth quarter of 2021, after which ownership costs grew significantly due to dramatically higher

interest rates and house prices. Over the three-year period from the fourth quarters of 2021 to 2024, homeownership costs increased $1,012, from $1,320 to $2,332. Current homeownership costs as of the fourth quarter of 2024 are $639 higher than renting,

creating a disincentive to own. See Exhibit 5

In summary, between 2014 and 2021, homeownership costs were 76% of rental costs; but since then, homeownership costs are 122% of rental costs. The double-barrel hit of rapid house price appreciation and the jump in interest rates flipped the script on

housing affordability.

Headwind #5: Renting is a more viable option than owning in today’s market.

Will the howling headwinds persist in 2025 and beyond for first-time homebuyers?

The perfect storm hit first-time homebuyers between 2022 and 2024, and the headwinds from that storm have not subsided. But when, and which of those winds, will calm in the coming year(s)?

Mortgage interest rates dipped to 6.1% in late September 2024, only to march back up to 6.60% as 2024 came to a close. During 2025 and beyond, mortgage interest rates are expected to moderate to the range between 5.75% and 6.25%. While it could take much

of 2025 and beyond to reach those rates, it appears as if the economy is currently showing signs of slowing, which could allow for rates to fall back to the low 6% range before midyear 2025.

The tight supply of existing for-sale homes eased a bit in 2024 and is expected to continue to do so throughout 2025. After three years of a very tight supply of for-sale homes, the market will open up in 2025. While many homeowners will age in their

current residence with a low mortgage rate, there are a growing number of owners who have no mortgage or a low mortgage amount relative to the house price, allowing them the financial ability to list their homes for sale. As the supply of actively

listed homes increases, price increases are unlikely to outpace wage and inflation rates.

Lastly, the wealthiest 50% of households have housing options, and many of them are now empty nesters. As luxury rental housing emerges in many suburban locations, empty nester households will be able to age in place in their current communities and exit

homeownership, generating the needed churn in the single-family housing market.

In summary, the winds of 2022 to 2024 made it difficult for first-time homeowners to weather the perfect storm. While these headwinds will not go away in 2025, they will subside to a breeze, allowing the peak years of the millennial cohorts to be first-time

homeowners!

Mark J. Eppli, Ph.D., of the UW-Madison James A. Graaskamp Center for Real Estate is one of Wisconsin’s leading real estate economists. Dr. Eppli is widely published in the fields of commercial real estate finance, development and evaluation.